The Most Expensive Investment Mistake This Year? A New Launch.

How Investors Lose Money & Mess Up This New Launch Season— By Trusting Overhyped Projects They Can’t Exit

(How To Avoid Blind Balloting, FOMO, Developer Price Hikes & Panic Buying)

[ACHIEVEMENTS]

Why Work With Us?

1. Buyers buy New Launch to Stay-We use it to grow from $1m to more than $5m Net Asset Value in less than 5 years.

We’ve never treated property like a destination. It’s not a Forever Home — it’s a MOVE.

We’ve bought new launches we never stayed in. We exit from it, and unlock the gains — again and again.

That’s how we grew from $1M to $5M+ in net assets — in under 5 years.

No emotions. No “dream home” thinking. Just clear steps, clear exits, and new launches that worked for the climb.

Because we don’t buy to stay. We buy to grow. Its the key to your next 3 moves.

2. You Already Know You’re Buying To Sell — So Let’s Make Sure You Buy What Actually Sells

You’re not here to fall in love with a unit. You’re here to move capital, exit with growth, and repeat the process — but sharper every time.

The hard part isn’t intent. It’s clarity. With too much noise and too little structure, even serious buyers guess.

That’s why we don’t just help you decide on a unit. We select, eliminate, and plan. We help you ballot smart, decide and exit when the time is right.

3. You’re Right To Be Skeptical. Property Agents Sell Anything.

Agents say every new launch is good. Every unit is a good buy. But when everything looks the same, nothing stands out.

That’s when buyers chase hype — and get stuck. We cut through the noise. We eliminate fast, shortlist what performs, and help you move with precision — not pressure.

Because this isn’t about buying one property. It’s about building a portfolio that moves when you do. It’s Asset Strategy — and Agents can’t offer that because they’ve never done it themselves.

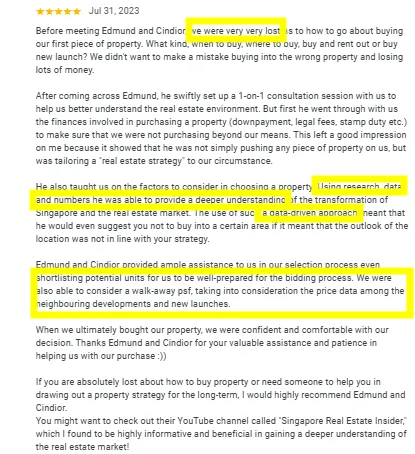

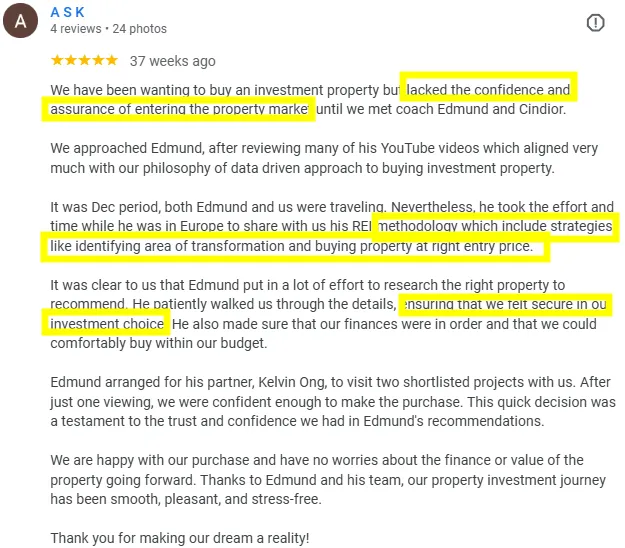

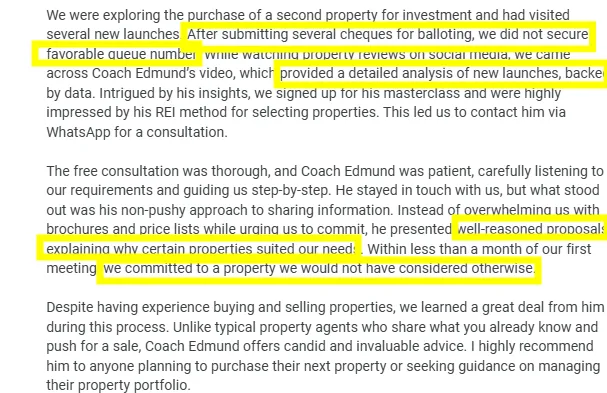

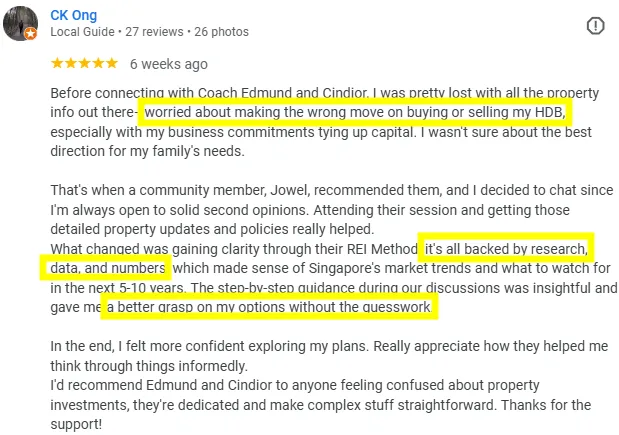

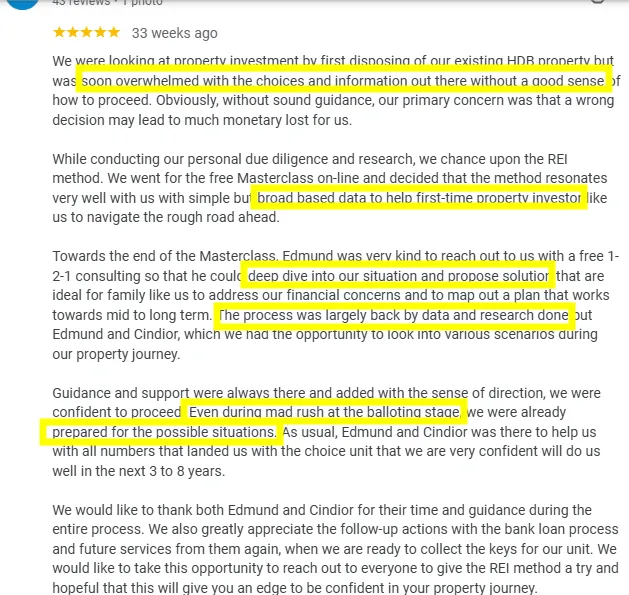

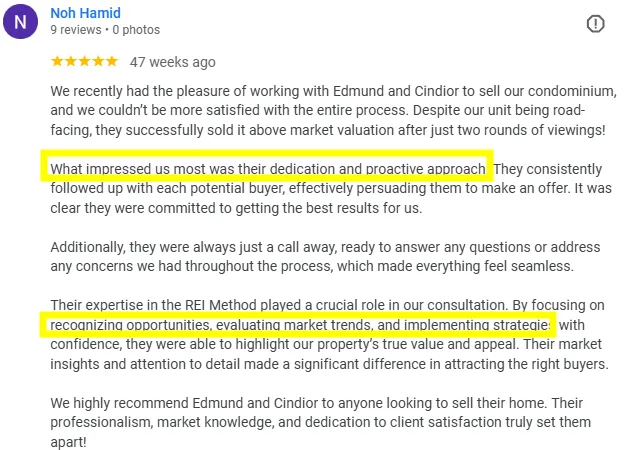

Hundreds of Homeowners Have Apply New Launch Ladder™ In Every New Launch Season

You Can Be Next Too

Edmund Tan & Cindior Ho

Turned $1M Into $5M+ Portfolio with New Launch Strategy

Stuck 10+ years in <$600K HDB.

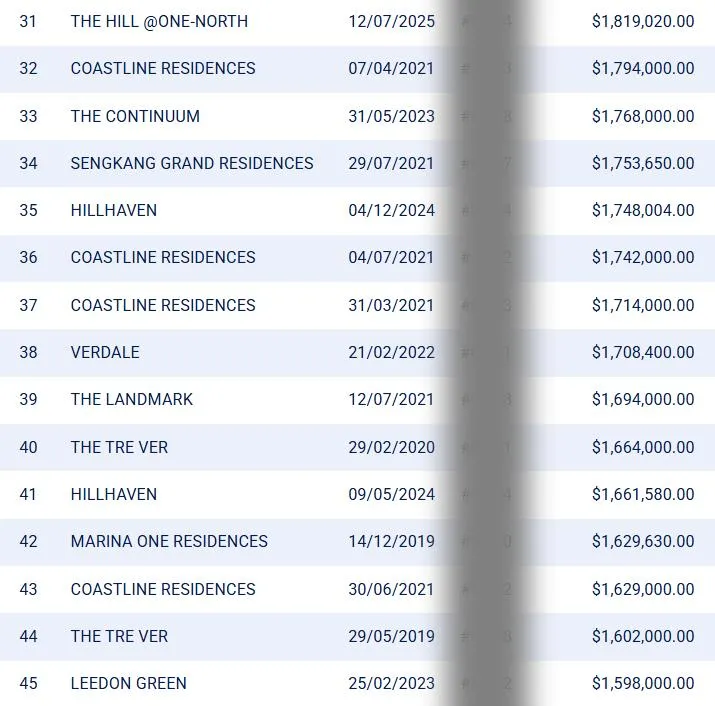

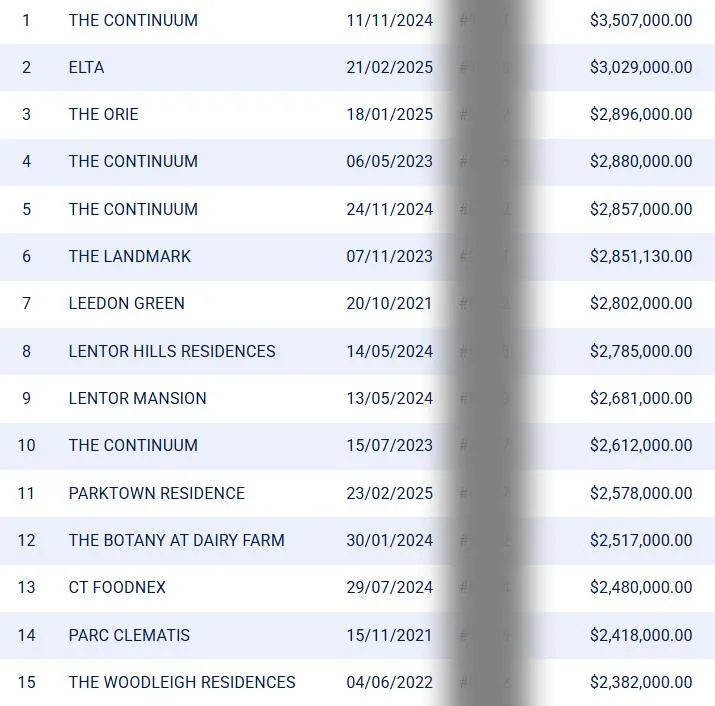

1st move: Tre Ver 2-bed at $1.05M → sold $1.28M → reinvested into $3M property (under 4 years).

2nd move: Parc Clematis 2-bed at $1.15M → sold $1.525M (3 years).

Built $5M+ portfolio with Buy-Not-to-Stay strategy.

Wish they switched 10 years earlier.

This isn’t theory. This is our own portfolio — built by following the same plan we guide others through.

Stuck 10+ years in <$600K HDB.

1st move: Tre Ver 2-bed at $1.05M → sold $1.28M → reinvested into $3M property (under 4 years).

2nd move: Parc Clematis 2-bed at $1.15M → sold $1.525M (3 years).

Built $5M+ portfolio with Buy-Not-to-Stay strategy.

Wish they switched 10 years earlier.

This isn’t theory. This is our own portfolio — built by following the same plan we guide others through.

Edward & Rose

$500K Gained in 4 Years → $3.5M+ Net Asset Value

Owned a freehold 2-bed in OCR, next step seemed obvious: upgrade to 3-bed near family.

Comfortable but limited growth — realised it wasn’t just about space, it was about what comes after.

Switched to Buy-Not-to-Stay: bought a new launch, 1 year from TOP, in rising RCR.

Within 4 years, gained >$500K and crossed $3.5M NAV.

By skipping comfort, they turned an upgrade into lasting leverage with the next move already mapped.

Owned a freehold 2-bed in OCR, next step seemed obvious: upgrade to 3-bed near family.

Comfortable but limited growth — realised it wasn’t just about space, it was about what comes after.

Switched to Buy-Not-to-Stay: bought a new launch, 1 year from TOP, in rising RCR.

Within 4 years, gained >$500K and crossed $3.5M NAV.

By skipping comfort, they turned an upgrade into lasting leverage with the next move already mapped.

MoK & Jine

From Stuck HDB to $3M+ Portfolio with $235K Gains

Owned 4-room HDB (~$600K) for 15 years — fully paid but no growth.

Wanted to upgrade, but fear of overcommitting kept them stuck.

Switched strategy: bought 2 x 3-beds — one to stay (~$1.2M), one for rental (~$1M).

Rental income offset loans, structured with 8 years of reserves.

Gained >$235K across both units, portfolio now valued >$3M.

Kept safety net intact while breaking free of the one-property trap.

They owned their 4-room HDB (worth ~$600K) for over 15 years

Life was steady — no mortgage stress, fully paid, raising a family

But their asset had stopped working for them: no growth, no leverage, no movement

They wanted to upgrade, but the fear of overcommitting stopped them

Instead of stretching to co-own one private unit…

→ They split and bought 2 x 3-bedrooms:

• One for stay (~$2M)

• One for rental (~$1.5M)

→ Rental income offsets loan

→ Finances structured with 17 years of reserve runway, even if they stopped workingNo emotional buying. No rushed upgrading. Just structured climbing.

$235K in gains across both units

Portfolio now valued over $3.5M

Next consolidation move planned to start their Legacy Ladder for their kids

They didn’t stay put. They climbed — and kept their safety net intact.

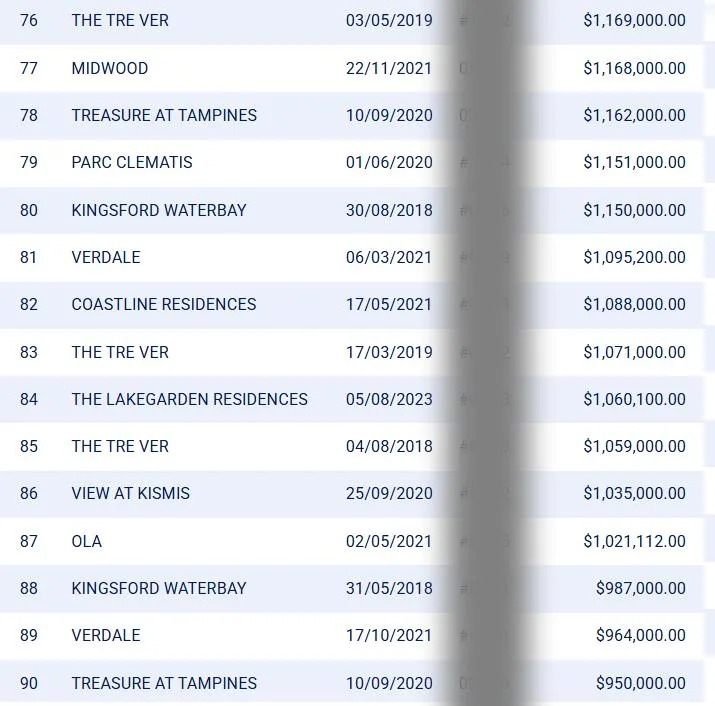

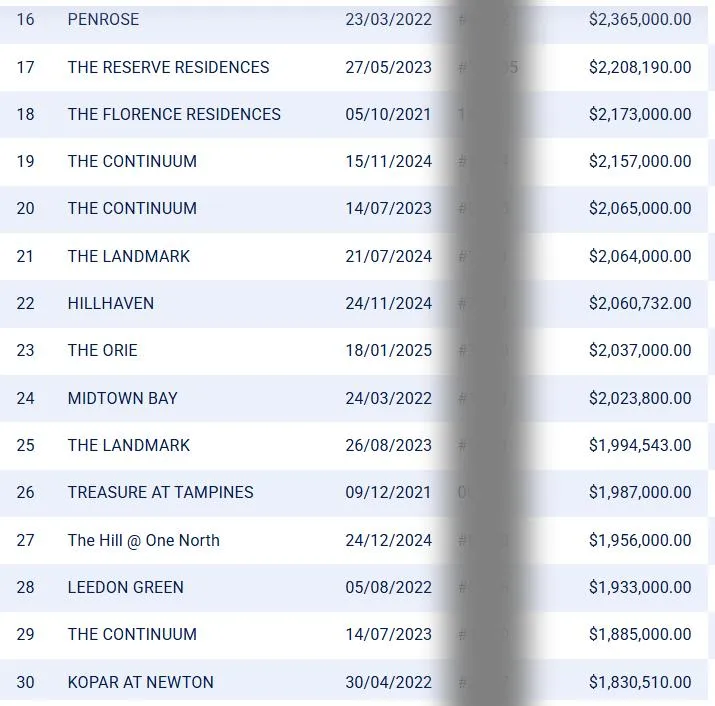

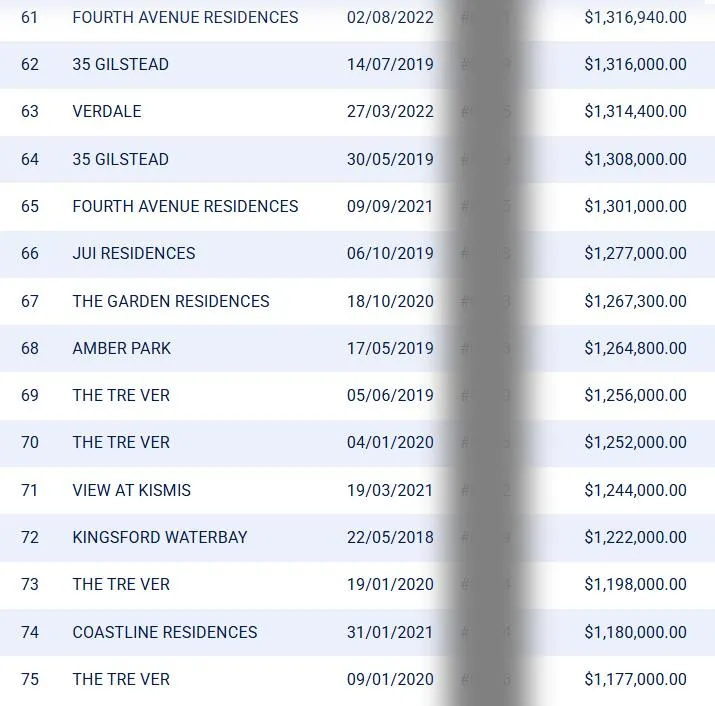

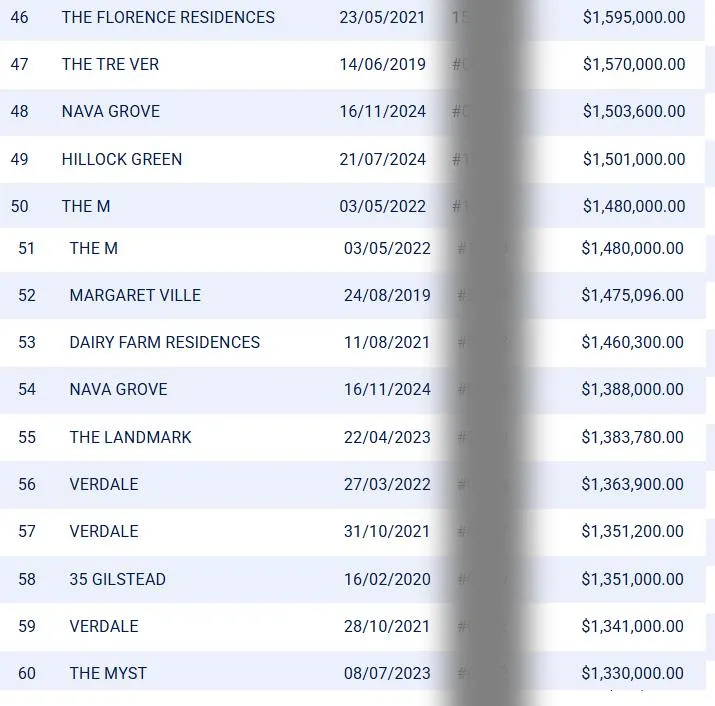

Here Are More Results From My Clients

Here Are Even More Results From My Clients

(More Than $160,014,029 Total Value)

APPLY FOR YOUR

New Launch Ladder™ CONSULTATION

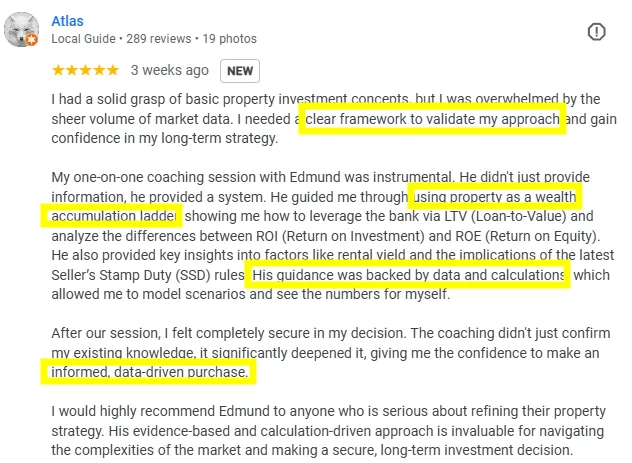

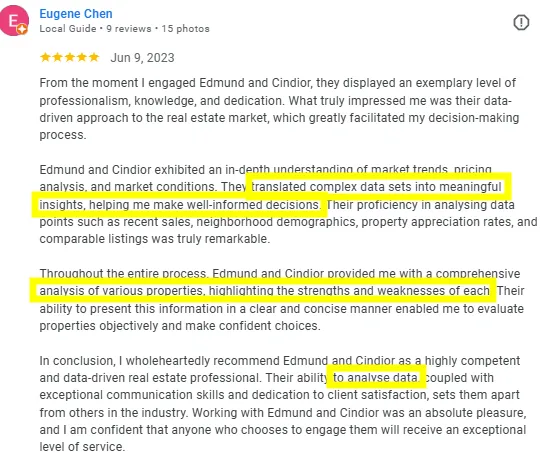

⭐️ This Isn’t A Sales Call. It’s Your New Launch Ladder™ Strategy Session.

You’ll walk away with:

We’ll identify your current position and map your next 3 property moves — so every launch becomes a stepping stone, not a dead end.

You’ll see how we apply 8 investment-grade filters to disqualify 90% of launches — so you never get trapped by hype, emotion, or high commissions.

We’ll outline how this launch fits your long game: when to exit, how to protect your upside, and how to re-enter stronger — before you even buy.

This is not for everyone.

It’s for serious buyers who already know they’re buying to sell — and want every move to compound.

Answer a few basic questions, tell us about your current situation and where you want to be by the end of the year.

If we believe we can help you buy New Launch to grow your Net Asset Value, my team will schedule a call with you.

If we’re a right fit, I’ll personally help you build your New Launch Ladder™ so you and your family can benefit with this advantage.

This isn’t Theory or guess work. It’s the exact Execution we've done over 100 new launch results that has build over $160M+ proven value regardless of any market conditions, among ourselves and the families who partnered with us. We've seen what traps buyers — and what actually grows.

You are 1 Property Away.

Disclaimer: The information and content provided on this page are not to be interpreted as a promise or guarantee of any specific outcomes or results.

Do note that results may vary on a case-by-case basis as I analyse the suitability of your property and determine if I can assist you further.